The process of making your way through vehicle taxation in the U.S. can be somewhat of a foreign language reading road signs experiment- it is notably harder because each state has its own rulebook. Relax though, we have done the heavy lifting for you. Vehicle Tax Rates

This comprehensive 2025 guide has all the information you require concerning vehicle taxes, how to verify the vehicle tax rates, and what influences how much you pay the tax which includes the car value, and your ZIP code.

It does not matter what you drive a modest sedan, a luxury SUV, or a roaring Harley, this guide will serve as your ultimate pit stop.

What is Vehicle Tax in the USA? Vehicle Tax Rates

Vehicle tax is a charge or amount that has to be paid by the owner or operator of a motor vehicle to the state. It is usually gathered once a year, and contains various kinds of it such as:

- Registration fees

- Property taxes on vehicles

- sales tax on sale.

- Specialty plate fees

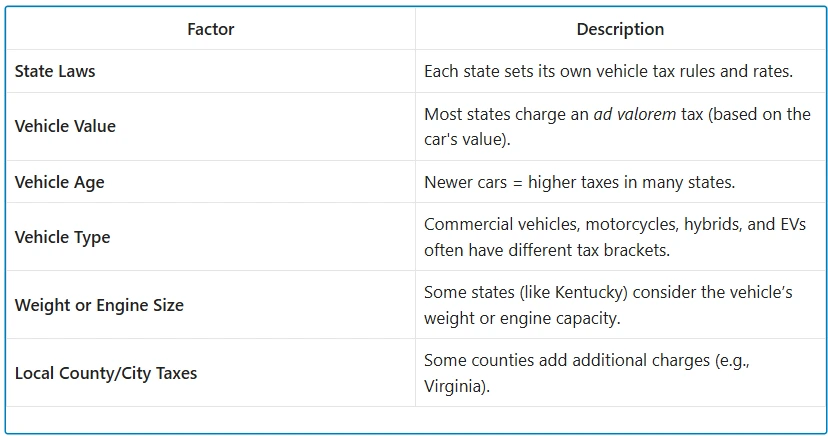

The tax rates on vehicles are madly different according to:

- Type of vehicle (commercial, electric, etc.)

- Engine power or mass.

- Vehicle age or market value

- Your condition and even your county.

Key Factors Affecting Vehicle Tax Rates in the USA

Before diving into the numbers, it helps to understand what determines how much you pay:

Types of Vehicle-Related Taxes in the USA

The following are a few of the significant vehicle taxes that you may meet:

- Registration Fees- You are required to carry a vehicle which means you have to register.

- Annual Vehicle Tax (Property or Ad Valorem Tax) – According to the value of the vehicle.

- Sales Tax– This is paid when a car is being purchased whether new or used.

- Title and Transfer Fees– When ownership changed.

- Specialty Taxes- EV taxes, road use taxes, luxury vehicle tax.

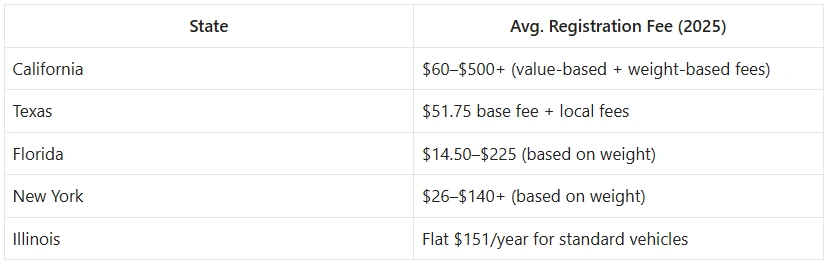

Vehicle Registration Fees (By State)

These fees can include:

- Base fee

- County/district taxes

- Highway improvement fees

- Additional surcharges

Vehicle Transfer Fees Vehicle Tax Rates

If you’re buying or selling a car, you’ll also need to pay:

- Title transfer fee (Varies by state: $15–$50)

- Smog check or inspection fees (where applicable)

- Sales tax (often 4%–8% of the vehicle’s sale price)

Annual Vehicle Property Tax

In states like Virginia, North Carolina, and Missouri, you’ll pay a personal property tax on your vehicle every year.

It’s based on:

- The current market value of your vehicle

- A local tax rate (0.5%–4.5% depending on where you live)

Tip: Some states reduce this tax as your vehicle ages.

Motorcycles, Scooters & Mopeds Tax Rates

Already Registered Bikes:

- Low annual fees (often $10–$30)

- May require emissions testing (e.g., Arizona)

New Registrations:

- One-time registration fee

- Title and inspection fees

States like California and Texas also require separate motorcycle endorsements or permits.

Passenger Cars (By Engine Size or Value)

Some states (like Connecticut) use vehicle value to determine taxes, while others (like Montana) go by engine size or weight.

Examples:

- Colorado: Vehicle age + weight = registration cost

- Georgia: One-time Title Ad Valorem Tax (TAVT) = ~6.6% of vehicle value

Luxury & High-End Vehicle Tax Rates

Got a Bentley or a Tesla Plaid? Get ready for extra fees!

Some states impose Luxury Vehicle Taxes:

- New Jersey: Additional tax on vehicles over $45,000

- Washington: Higher RTA tax for vehicles over $35,000

- California: Progressive registration based on car value

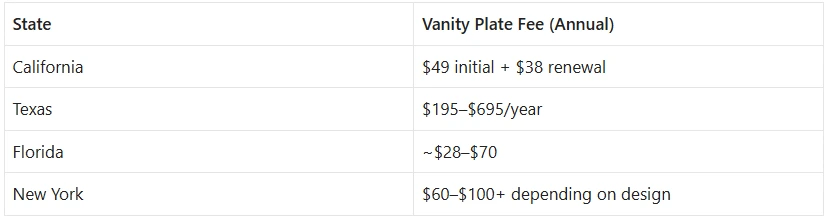

Vanity or Premium License Plate Fees

We want a personalized plate? Costs are listed below:

Penalties for Late Registration or Tax Payment

Late fees can stack up quick:

- California: 160% or more of your original fee after 2 years or later.

- New York: $50–$300 depending on delay

- Virginia: Vehicle can be impounded.

Note: The majority of states have internet payment platforms or renewal autopilot to prevent late payments.

DMV Portals and Vehicle Tax Services by State

The following are some of the well-known links to vehicle tax rates checker tools:

- California DMV Fee Calculator.

- Texas DMV Registration Calculator

- Florida Registration Fees Chart.

- Virginia Vehicle tax estimator.

Online Vehicle Tax Rates Check, Payment & Calculators (State Links)

The following are some of the well-known links to vehicle tax rates checker tools:

- California DMV Fee Calculator.

- Texas DMV Registration Calculator.

- Florida Registration Fees Chart.

- Virginia Vehicle tax estimator.

Popular Searches We Help With:

- Vehicle tax rates checker USA.

- Calculator Vehicle registration fee.

- ZIP vehicle tax rates.

- DMV tax calculators

- Electric vehicle tax fees.

- Rates of vehicle tax on a state-by-state basis.

State-wise Vehicle Tax Rate Breakdown (Mini Guide)

California:

- Increased vehicle license fee on a progressive basis.

- An increase in charge on heavier or newer.

Texas:

- Flat charge plus county charges.

- The fees of inspection and emissions depend on the region.

New York:

- Weight-based registration

- Surcharges on luxury vehicles and commercial vehicles.

Florida:

- One of the lowest base fees.

- Individual plate charges are expensive.

Illinois:

- Flat $151 registration

- $100 extra for EV registration fee.

New Car Tax & Registration Fee Calculator

Want to know what all it will cost you? Calculate the vehicle tax by using a vehicle tax calculator device to obtain:

- Sales tax

- Registration fees

- Transfer/title fees

- Property tax (if applicable)

Try tools like:

- Edmunds Car Cost Calculator

- NADA Guides

- Your local DMV fee estimator

Why Use Online Tools to Check Vehicle Tax Rates?

- Before you sell/buy, get the estimates right.

- Avoid surprise charges

- Save time at the DMV

- Pay tax and renew registration simultaneously.

FAQs About Vehicle Tax Rates in the USA

What is my online check of vehicle tax rate?

Go to your state DMV site or make use of a service like Edmunds, NADA or Carvana tax calculator.

Are there differing taxation in electric cars?

Yes, there are also states that impose extra fees to EV to compensate the loss in the fuel taxes.

Does their vehicle taxes change every year?

Yes, rates are revised annually, and they are usually determined by inflation, depreciation of the vehicle, or the changes in the legislation.

Which are the states with the lowest vehicle taxes?

Oregon, Montana and Alaska have a low to no registration or property tax on automobiles.

What will be the case when I fail to pay my vehicle taxes?

There is the risk of fines, the registration suspension, or even impounding your car.

Drive Smart: Stay Updated on Your State’s Vehicle Tax Laws

Over-paying vehicle taxes? Or worse, paying late?

Don’t become a victim of the system. Bookmark your state DMV portal, check a vehicle tax rates checker and keep up-to-date with annual changes.